(Nov. 13, 2025)

After 43 days, the longest shutdown in U.S. history is over.

Federal employees are returning to work, national parks and museums are reopening, and air travel disruptions are easing ahead of the holiday season. Back pay for furloughed workers is expected as early as next week, but agencies face a backlog that will take time to clear.

Why this matters for irrigation: The legislation that ended the shutdown does more than restart operations—it locks in full-year funding for USDA and FDA through Sept. 30, 2026. In fact, the entire federal government is now funded through January 30, 2026, with USDA and FDA insulated from any further shutdown risk until the fiscal year ends next September. Three annual appropriations bills were bundled into the package:

- Agriculture (USDA and FDA)

- Legislative Branch (Congressional operations)

- Military Construction–VA (Veterans Affairs and military projects)

For IA members, this stability is critical. USDA can keep NRCS offices staffed, move EQIP contracts forward, and maintain conservation planning without fear of another funding lapse. EPA’s WaterSense program also resumes, restoring momentum for efficiency labeling and rebate coordination. Expect some delays as agencies dig out from weeks of inactivity, but the path ahead is clearer.

(Nov. 11, 2025)

The Senate advanced a bipartisan package to end the shutdown on Sunday, November 10. It funds the federal government through January 30, 2026 (with extended funding for certain agricultural programs), restarts agency operations, guarantees back pay for furloughed employees, and authorizes rehiring for some federal positions.

This is a big, positive step, but the House of Representative still must vote on the Senate package before the government reopens. An optimistic timeline would have the government reopening this week or early next week.

If the House approves the Senate package, this will provide much needed stability for IA members who depend on USDA and EPA being open for business. For the Green Industry, resumed EPA operations also mean continuity for WaterSense, the federal program that helps customers identify efficient irrigation products and reduce outdoor water waste.

For agriculture, the Senate package includes a one-year extension of key 2018 Farm Bill authorities, keeping conservation and other farm programs running through September 30, 2026, and it funds SNAP through September 30, 2026. Practically, this avoids disruptive lapses in program authority while Congress continues broader negotiations.

Why passage matters for irrigation: with agencies open and authorities extended, NRCS can keep field offices staffed, continue conservation planning and technical assistance, and move EQIP contracts from design to implementation on a predictable timeline—supporting irrigation upgrades like pressure regulation, repairs, and smart scheduling through FY2026. The result should be fewer start-stop delays for producers, contractors, and districts engaged in EQIP-related work.

Travel note for those planning on attending the 2025 Irrigation Show and Education Week: FAA-mandated flight cuts and delays mounted during the shutdown, but once funding is restored, airlines and air traffic facilities should be able to unwind reductions over the coming days to a few weeks, returning to normal operations ahead of the IA’s Irrigation Show and Education Week in New Orleans from Dec. 8–11.

Shutdown drags on to week 5 and impacts are mounting; lingering impacts after reopening are likely

Updated: Nov. 3, 2025

The federal government shutdown—now in its fifth week—continues to ripple across the broader economy and the water sector. The Congressional Budget Office estimates the shutdown is shaving billions from economic output, with losses rising the longer it lasts. For irrigation businesses, the headline risk is not only slower federal activity today but also the knock-on delays once agencies restart normal operations.

Even when the shutdown ends, a backlog on government programming and funding is likely. Applications, contracts and program reviews that stack up during a multi-week pause usually return all at once, competing for limited staff time. CBO’s analysis underscores that while some lost activity can rebound, not all of it does—another reason many firms should plan for a slower-than-usual ramp-up period as agencies dig out. Building extra lead time into project schedules and procurement plans may help cushion these delays.

Policy crosscurrents add uncertainty in the future. Current debates over the Supplemental Nutrition Assistance Program (SNAP) may influence the tone and timing of future Farm Bill discussions. SNAP typically represents a large share of Farm Bill spending; shifts in SNAP policy can complicate negotiations that also touch conservation and irrigation-relevant programs. Impacts to SNAP during the shutdown illustrate how politically complicated SNAP funding and implementation has become, raising questions about what compromises will be on the table when future Farm Bills are being considered.

And there are potential indirect effects on the irrigation industry as well. A prolonged federal shutdown is a headwind for new-home construction, with delays in FHA/VA/USDA loan processing, potential interruptions to flood-insurance underwriting and a pause in key federal data releases that builders and lenders use to plan.

Even after a reopening, backlogs in inspections, endorsements and program actions can keep projects moving slower than usual for several weeks.

For the irrigation industry, this matters directly: New residential starts drive demand for landscape irrigation systems—both individual lots and shared green spaces—and slower closings or deferred starts can ripple through distributors, contractors and manufacturers. For more information on how the shutdown may affect housing, see the National Association of Homebuilder’s coverage.

Finally, on WaterSense and EPA programs more broadly, the concern isn’t just temporary delays but potential “chilling effects” on staffing and program momentum. Prolonged uncertainty, hiring freezes or employee attrition may slow labeling, guidance updates and coordination with stakeholders like the irrigation industry—effects that may linger beyond the shutdown period.

Updated: Oct. 27, 2025

Status: As the federal government shutdown stretches into its fourth week, irrigation professionals across agriculture and landscape sectors are feeling the strain. With no clear path to reopening, critical programs that support water efficiency and conservation are on hold, creating uncertainty for farmers, contractors and manufacturers alike. The Irrigation Association continues to monitor developments and advocate for solutions that minimize disruption to our industry.

EQIP: Agricultural Conservation at a Standstill

The USDA’s Environmental Quality Incentives Program, a cornerstone for agricultural conservation planning and cost-share assistance, has been significantly impacted. NRCS offices nationwide remain closed, halting EQIP contracting, technical assistance and payments for completed projects. Similar to what’s being reported here, specific reports of payments not being received are starting to emerge. Farmers who rely on EQIP funding to implement irrigation upgrades and water-saving technologies are facing cash flow challenges and project delays. These disruptions ripple through the supply chain, affecting equipment purchases and long-term conservation goals. Even when the government reopens, the backlog of work is likely to further delay payments.

WaterSense: Landscape Efficiency on Pause

On the landscape side, the EPA’s WaterSense program — essential for promoting water-efficient irrigation products and professional certifications — is also paused. While operations continued for a period after the shutdown began, the IA has confirmed that WaterSense staff have now been furloughed as of last week. This delay affects manufacturers awaiting certification for irrigation controllers and sprinkler bodies, as well as utilities planning rebate programs tied to WaterSense standards. Prolonged inactivity could slow adoption of water-saving technologies and complicate compliance timelines for state and local efficiency codes.

What’s Next for Irrigation Businesses?

The longer this shutdown continues, the more everyday operations — from conservation planning to rebate program implementation — will feel the strain. The IA urges members to share real-world impacts, such as delayed site visits or payment disruptions, so we can elevate these concerns to policymakers. While negotiations remain stalled, the upcoming Affordable Care Act enrollment period may serve as a political turning point, but no resolution is guaranteed.

Updated: Oct. 20, 2025

Status: The shutdown has now stretched into its fourth week, making it the longest full government shutdown in U.S. history. An estimated 750,000 federal employees are furloughed and there’s still no clear path to reopening.

The House remains out of session, and Senate negotiations are stalled as both parties dig in ahead of the Nov. 1 Affordable Care Act open enrollment date, which is when notice of increased premiums are expected to hit andis emerging as a potential turning point in negotiations.

What’s happening in Washington:

- Congressional gridlock: The Senate will hold yet another vote on the House-passed CR this week—expected to fail. A GOP bill to pay federal workers without reopening the government is also on deck. Another vote is expected this week on bill that would pay federal employees, including military service members, required to work during the government shutdown.

- Real-world strain: Federal employees missed their first full paycheck last week; credit unions are offering “shutdown relief” loans. Air traffic disruptions and court slowdowns are looming.

Impacts for the irrigation industry:

- USDA: Offices nationwide remain closed, stalling farm program payments, conservation technical assistance, and EQIP contracting. Loan processing for farmers and small businesses is halted.

- EPA: Nearly 90% of staff furloughed; WaterSense updates, permitting, and grant activities are paused, creating uncertainty for compliance timelines.

- Trade: The Office of the U.S. Trade Representative is still operating using special funds—critical for ongoing USMCA review and tariff processes—but prolonged shutdown could strain resources.

- Labor & immigration: E-Verify remains offline, complicating hiring and I-9 compliance. Labor certification steps for H-2B visas are frozen.

- Nutrition programs: WIC and SNAP face funding warnings for November, signaling broader economic ripple effects.

What to watch next:

- Nov. 1 Affordable Care Act open enrollment could become the political “off-ramp” for reopening, but no deal is guaranteed.

- If you experience delays in site visits, payments, or trade-related processes, please share those impacts with IA so we can elevate real-world examples to policymakers.

Bottom line for irrigation businesses:

The longer this shutdown continues, the more everyday operations—from conservation planning to federal data releases—will feel the strain.

The IA will keep members informed with timely updates and official resources.

Questions or impacts to report? Contact Andrew Morris (andrewmorris@irrigation.org) or Luke Reynolds (lukereynolds@irrigation.org).

Updated: Oct. 13, 2025

Status: The federal government shutdown has now entered its third workweek, with no clear end in sight. While military pay will continue after a weekend announcement from President Trump, employee furloughs, reductions in force, and other impacts at agencies are growing.

What’s happening in Congress:

- Negotiations remain stalled, with little movement between congressional leaders.

- Republicans have shifted tactics, blocking votes on Democratic stopgap funding bills and keeping the House out of session.

- Democrats are holding firm, focusing on the upcoming Nov. 1 open enrollment for Affordable Care Act insurance as a key pressure point.

- Layoffs and furloughs are increasing, and federal courts may scale back operations after Friday. Air travel disruptions are also being closely watched.

Impacts for the irrigation industry:

- USDA and EPA are operating with more limited staff, meaning greater risks of impacts to conservation technical assistance, payments and program timelines.

- No new updates on WaterSense, EQIP or other core programs—expect continued delays in approvals, reimbursements and data releases.

- The Office of the U.S. Trade Representative remains open for now, using special funds to maintain operations, which is important for ongoing USMCA reviews and trade processes.

What to watch next:

- The Nov. 1 Affordable Care Act open enrollment date is emerging as a potential turning point in negotiations.

- If you experience specific delays (site visits, payments, trade-related timing), please let us know so we can share real-world impacts with policymakers.

Bottom line for irrigation businesses:

We’re continuing to monitor agency contingency plans and congressional developments. The longer the shutdown continues, the more likely it is that everyday operations and federal program delivery will be affected. The IA will keep members informed as new details emerge.

Questions or impacts to report?

Contact the IA Government & Public Affairs team: Andrew Morris (andrewmorris@irrigation.org) or Luke Reynolds (lukereynolds@irrigation.org).

Updated: Oct. 6, 2025

Status:

Shutdown continues – Focusing on agencies that most affect the irrigation industry

The federal government remains in a shutdown after funding lapsed at 12:01 a.m. on Oct. 1 with no meaningful progress over the weekend. That means many “non-essential” services are being paused while agencies follow their contingency plans. Past shutdowns show the longer this goes on, the more everyday activities feel the strain—from delayed services and payments to fewer federal data releases businesses rely on. We’re watching the outlook closely and will continue to provide updates.

For irrigation-relevant programs, we’re tracking what this means. USDA’s plan shows widespread furloughs and pauses in areas our members feel—like conservation technical assistance and certain payments—until funding is restored. EPA’s plan also scales back to a small “excepted” team during a lapse, creating uncertainty around program timelines. We’ll share concrete impacts as agencies implement their plans.

Good news on the trade front: The Office of the U.S. Trade Representative (USTR) is not planning furloughs right now. USTR’s shutdown plan allows the agency to use “no-year” funds and multiyear USMCA enforcement funds to keep staff working. That continuity matters with the USMCA joint review ramping up after a recent notice — public comments and a hearing are already in motion.

Bottom line for the irrigation industry: We’ll stay on top of shutdown developments and what they mean for your operations—from conservation program delivery and federal data releases to trade processes tied to North American supply chains. If you’re seeing specific delays (site visits, payments or trade-related timing issues), please let us know so we can share real-world examples with policymakers and keep the industry informed.

Updated: Oct. 1, 2025

Status:

The federal government officially shut down at 12:01 a.m. today after Congress failed to pass a continuing resolution or full-year appropriations. Negotiations remain stalled, and no clear timeline for reopening has emerged.

What’s happening now:

- Millions of federal employees are furloughed; “essential” staff continue without pay.

- The Environmental Protection Agency is furloughing approximately 89% of its employees, and the full shutdown plan can be found here. While exact details remain unclear, it seems likely that for EPA WaterSense this will mean

- a pause on website and product/partner listing updates.

- no new label authorizations or partner approvals.

- outreach and routine communications on hold.

- a halt to new specification or program policy work.

- The Natural Resources Conservation Service is furloughing approximately 96% of its employees, and the full shutdown plan can be found here as part of USDA’s overall plan.

- During the 2018-2019 shutdown, NRCS initially continued operations using carryover/mandatory funds, then announced plans to begin furloughs on Feb. 3, 2019, to conserve balances and focus excepted staff on mandatory programs—plans not implemented because the shutdown ended Jan. 25.

- Environmental Quality Incentives Program: Even with some mandatory funds, as the shutdown progresses, EQIP intake/contracting and payment processing may be paused, with only life/property-protection work continuing. Learn more on the USDA Lapse of Funding plan.

- Technical Service Provider Program: Conservation planning and TSP reimbursements that need NRCS action may be delayed.

The IA is working to determine the detailed impacts on programs most important to its members.

(Sept. 26, 2025)

Where things stand: Congress has a funding deadline on Sept. 30. Without a short‑term funding bill (continuing resolution) or full‑year appropriations, a partial government shutdown would begin Oct. 1. While the House recently passed a continuing resolution, negotiations appear to have stalled after competing short‑term funding bills failed in the Senate.

What a lapse means in practice: Some federal services pause. Many employees are furloughed except activities that protect life and property continue. Programs funded by fees or mandatory dollars may keep operating, though delays are possible. Impact varies by agency.

Potential impacts for irrigation industry stakeholders

- USDA (NRCS, FSA, RMA, NASS): Expect delays in approvals, reimbursements and some data releases; some technical assistance may pause. In terms of specific impacts to EQIP at NRCS:

- Existing EQIP contracts are financed with mandatory Farm Bill funds (via the Commodity Credit Corporation), so a shutdown doesn’t “defund” them. The money is still legally available.

- New EQIP funding rounds - Announcements, application intake, and obligation of new contracts typically pause during a shutdown unless specifically excepted USDA

- Technical assistance - Most non-emergency field assistance and conservation planning pause; emergency/safety work can proceed under the contingency plans.

- U.S. Department of the Interior / Bureau of Reclamation: Excepted operations (e.g., dam safety, essential deliveries) continue; planning and grant activities may pause.

- EPA: Most staff would be furloughed under the current plan; grants, some permitting and routine compliance interactions could halt; emergency/superfund oversight continues.

- Immigration (USCIS/E‑Verify): USCIS typically continues (fee‑funded) but may run slower. E‑Verify is historically unavailable during a shutdown, affecting onboarding and I‑9 workflows.

- Department of Labor (OFLC/H‑2B steps): Furloughs likely; labor‑certification steps may pause even if USCIS remains open.

- SBA / EXIM: New commitments often pause; servicing of existing loans is limited per agency guidance.

What you can do now

- Plan for paperwork and payment delays tied to USDA programs (NRCS/FSA) and federal grants.

- Prepare hiring contingencies if E‑Verify goes offline (e.g., document collection and calendar reminders for reverification steps when systems return).

- Coordinate with federal partners/contracting officers on site access and invoicing if you have federal contracts or projects at federal facilities.

- Document impacts (delays, cost increases, staffing issues) so we can elevate concerns where appropriate. Share your impacts by emailing Andrew Morris or Luke Reynolds at andrewmorris@irrigation.org or lukereynolds@irrigation.org.

IA’s role

We’ll track federal funding developments and publish updates relevant to irrigation businesses, including clear links to official agency guidance. If a lapse occurs, expect a status update here and via our member communications.

Official resources

Questions? Contact the IA Government & Public Affairs team - Andrew Morris or Luke Reynolds at andrewmorris@irrigation.org or lukereynolds@irrigation.org.

(Sept. 11, 2025)

The United States–Mexico–Canada Agreement (USMCA) requires a formal review every six years.

The next review begins July 1, 2026, with public consultation and congressional reporting steps starting as early as fall 2025. For irrigation equipment manufacturers, distributors and contractors, this process matters because of how deeply integrated North American supply chains and markets have become.

The review process

Under U.S. law, the Office of the U.S. Trade Representative (USTR) must:

- publish a Federal Register notice at least 270 days before the review begins (expected around October 2025) to collect written comments and schedule a public hearing.

- submit a report to Congress at least 180 days before July 2026 (by early January 2026) summarizing U.S. objectives, stakeholder input and trade impacts.

Congress, the White House, and USTR will all play visible roles in shaping priorities during this process. It will be the most significant opportunity since USMCA entered into force for industries—including irrigation—to highlight trade opportunities and challenges.

For more background on this process, see the Center for Strategic and International Studies.

Why it matters for irrigation

As IA’s recent economic analysis shows, irrigation equipment is both exported and imported across North America. The U.S. irrigation industry remains a net exporter, but imports—particularly from Mexico—are a meaningful part of the market. Between July 2024 and June 2025, imports of irrigation equipment for agriculture and horticulture (HTS 8424.82.0020) totaled more than $132 million, with Mexico alone accounting for over $95 million (roughly 72% of the total).

Canada remains one of the most important export destinations for U.S. irrigation equipment. According to IA’s trade analysis, Canada regularly accounts for a significant share of U.S. exports in this sector—reflecting strong demand for agricultural and landscape irrigation products north of the border. Close supply chain integration and shared standards between the two countries reduce costs and facilitate efficient cross-border trade. For many U.S. manufacturers, Canada represents not only a key customer base but also a dependable outlet for new technologies, particularly in areas such as precision agriculture and water-efficient systems.

Mexico and Canada are not just trade partners; they are essential for keeping irrigation equipment supply chains cost-effective and reliable. Many U.S. manufacturers rely on components or finished products that flow across these borders. At the same time, U.S. exports support jobs and help spread efficient irrigation technologies throughout North America.

“Stable, rules-based trade with Canada and Mexico is therefore critical for both importers and exporters in our sector.”

IA’s role

The Irrigation Association will be closely engaged in the 2026 USMCA review.

Our focus will be to ensure that decision-makers understand how important these trade relationships are to irrigation, and how tariff changes or policy uncertainty could affect our members. We plan to participate in the public comment process once the Federal Register notice is issued and will continue to monitor congressional hearings and USTR updates.

What members can expect

IA will keep members informed as the process unfolds—highlighting opportunities to provide comments, share perspectives, and shape outcomes that support efficient and competitive irrigation markets. Members should anticipate updates beginning later this year when USTR formally opens the public consultation docket.

(September 8, 2025)

Trade and tariff policies dominate national headlines, but their effects on the irrigation industry are less visible — and increasingly important to understand. This article will look at data on imports and analyze potential impacts from recent tariff news.

Bottom-line observations for irrigation equipment imports:

- The value of U.S. imports of self-propelled center pivot irrigation equipment is limited compared to other irrigation equipment.

- Imports from the China and Mexico alone make up 70% of total U.S. imports of other agricultural and landscape irrigation equipment, which makes U.S. tariff policy on imports from for these two countries the most important to focus on.

- Other than the imports from the Dominican Republic, no other countries exceed $10 million during this 12-month period.

- Imports make up a relatively small fraction of total domestic irrigation equipment and services economic activity.

Data from July 2024 to June 2025

The following data, organized and tracked by Harmonized Tariff Schedule (HTS), are from the U.S. Census Bureau’s USA Trade Online for the most recent 12-month period for which data is available, July 2024 through June 2025.

- 8424.82.0010 – Self-Propelled Center Pivot Irrigation Equipment

- Total - $5,749,050; further analysis not conducted given the low volume of imports

- 8424.82.0020 – Other Irrigation Equipment for Agricultural or Horticultural

|

July 2024 to June 2025 |

| Total Imports |

$132,570,829 |

| Mexico (1st) |

$95,647,911 |

| China (2nd) |

$10,838,059 |

| Dominican Republic (3rd) |

$7,765,172 |

| Israel (Noteworthy) |

$2,141,532 |

| Remaining countries combined |

$16,178,155 |

- 8424.82.0090 – Other Agricultural or Horticultural Spraying and Dispersion Equipment

|

July 2024 to June 2025 |

| Total Imports |

$47,694,841 |

| China (1st) |

$25,409,964 |

| Taiwan (2nd) |

$4,954,093 |

| Italy (3rd) |

$2,897,130 |

| Israel (Noteworthy) |

$2,407,282 |

| Remaining countries combined |

$12,026,372 |

Overall size of the irrigation domestic markets and export markets

Data from the 2020 IA report titled “Economic Impact of the Irrigation Equipment and Services Industry” (Economic Impact Report) is helpful for providing context on the size and scope of the import market, the domestic market and the export market. The Economic Impact Report and the HTS codes are categorized differently, the Economic Impact Report combined the cost of equipment with the cost of related installation services, and the years of comparison are different. Nonetheless, these numbers from the Economic Impact Report represent the best available data and they still offer a good sense of scale.

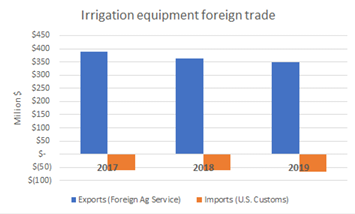

Consistent with the data in this article and the prior article on exports, the Economic Impact Report showed that the irrigation industry is a net exporter of equipment. This is captured in Figure 13 from the Economic Impact Report (see below).

Looking at the data from 2020 in the Economic Impact Report, here is the relative size of the market for irrigation equipment and services:

| Crop Irrigation |

$2,377,000,000 |

Residential and Commercial

|

$6,203,000,000 |

| Landscape & Horticultural |

$55,760,000 |

| Net Exports |

$284,000,000 |

| Total |

$8,919,760,000 |

Trade and tariff policies to watch

Viewed overall, imports from China and Mexico make up a meaningful portion of the overall irrigation equipment market. As of August 2025, U.S. tariffs on imports from China remain capped at 30% under a temporary 90-day truce that extends through Nov. 10, 2025, while China’s tariffs on U.S. goods are capped at 10%. High-level talks continue, with Chinese negotiators scheduled to meet in Washington later this year. While the future of Chinese tariffs remains uncertain, the 30% tariff level is not significantly higher than the average tariff rate under President Biden.

As of mid-2025, the U.S. has applied 25% tariffs on many imports from Mexico, though the USMCA framework ensures that roughly 84% of Mexican exports still enter the U.S. duty-free when they meet the agreement’s origin and compliance rules. This balancing act—tariffs on one hand, exemptions under USMCA on the other—has kept North American supply chains largely intact but created uncertainty for sectors reliant on Mexican components and finished goods. Looking ahead, the mandatory USMCA review in 2026 will be a pivotal moment for U.S.-Mexico trade relations, with both governments already consulting stakeholders to determine whether the pact will be reaffirmed, adjusted or face greater political friction.

Other countries may be important for certain products or manufacturers, but on a macro scale they are unlikely to have a significant impact on the irrigation industry as a whole. The IA, nonetheless, is being watchful for strategic opportunities to engage with noteworthy countries for U.S. irrigation equipment imports.

(July 30, 2025)

On June 4, 2025, new tariffs on steel and aluminum imports took effect, doubling the previous rate from 25% to 50%. The increase—announced by President Trump and implemented under Section 232 of the Trade Expansion Act—applies to nearly all countries, with only a limited exception for the United Kingdom, which remains at the 25% rate under a temporary trade arrangement. These tariffs are intended to support U.S. metal producers, but they also bring potentially higher costs for industries that rely on imported steel and aluminum, including the irrigation equipment sector.

Center pivot irrigation systems, which are widely used in American agriculture, require large amounts of steel—typically between 5 and 10 tons for a standard seven-span unit. This is a significant amount of steel, and like other pieces of farm and industrial equipment, center pivot manufacturing is considered a steel-intensive industry. Even though nearly all center pivots used in the United States are American made, they are exposed to the upward cost pressures based on the steel and aluminum inputs.

These tariffs are not new. First imposed during President Trump’s first term in 2018, the steel and aluminum tariffs remained largely in place under President Biden and have now been expanded in Trump’s second term. According to a recent Congressional Research Service report (R47107), these trade measures have become one of the most durable features of modern U.S. trade policy, despite ongoing debate about their long-term economic impact.

For farmers and irrigators, the higher material costs may change the equation when deciding whether to repair or replace an aging center pivot system. In the longer term, these tariffs could drive innovation—encouraging manufacturers to explore alternative materials or more efficient designs to reduce overall use of steel and aluminum.

Importantly, these higher input costs may be partially offset by pro-growth tax incentives and an additional $66 billion for ag-related programs included in the recently passed Big Beautiful Bill Act. Steel and aluminum tariffs seem likely to persist, and the agriculture and irrigation industries may need to adjust their business models to minimize cost pressures from tariffs and maximize the benefits of H.R. 1 (also known as the Big Beautiful Bill Act). Because steel and aluminum tariffs have been supported by presidents representing both parties, this policy durability may present longer term opportunities for American steel production and innovation in product design and manufacturing.

(June 25, 2025)

In recent years, Congress has increasingly used the budget reconciliation process to fund agricultural programs traditionally included in the Farm Bill. This trend, which began with the Inflation Reduction Act, has continued with the current Senate and House budget reconciliation proposals—collectively referred to as the “One Big Beautiful Bill” or OBBB. These bills include significant funding for agricultural conservation programs, including the Natural Resource Conservation Service’s Environmental Quality Incentives Program, a major source of federal support for irrigation modernization and water efficiency improvements.

If the version of the OBBB being considered by the U.S. Senate in late June 2025 becomes law, then the net effect will likely be positive for the irrigation industry. This would result in comparable overall funding levels through 2031, with unobligated IRA funding being eliminated in the near-term and baseline EQIP funding being increased significantly through the 2031-time horizon. Given challenges to NRCS staffing levels and a backlog in EQIP project implementation, somewhat lower funding levels in the near-term and higher levels in the long-term may match up well with business and administrative realities. Furthermore, by eliminating IRA funding and increasing the baseline, the more restrictive provisions attached to the IRA EQIP funding will no longer be applicable to new EQIP contracts, which may improve the chance that some irrigation practices will be funded.

Here's a deep dive of recent funding history along with the current Senate proposal related to the OBBB going forward. The House proposal is the same.

| Federal Fiscal Year |

Baseline Funding Authorizations (Current Law) |

IRA Funding Authorizations* |

Senate Baseline Funding Authorization (OBBB) |

| FY19 |

$1,750,000,000 |

|

|

| FY20 |

$1,750,000,000 |

|

|

| FY21 |

$1,800,000,000 |

|

|

| FY22 |

$1,850,000,000 |

|

|

| FY23 |

$2,025,000,000 |

$250,000,000 |

|

| FY24 |

$2,025,000,000 |

$1,750,000,000 |

|

| FY25 |

$2,025,000,000 |

$3,000,000,000 |

|

| FY26 |

$2,025,000,000 |

$3,450,000,000 |

$2,655,000,000 |

| FY27 |

$2,025,000,000 |

|

$2,855,000,000 |

| FY28 |

$2,025,000,000 |

|

$3,255,000,000 |

| FY29 |

$2,025,000,000 |

|

$3,255,000,000 |

| FY30 |

$2,025,000,000 |

|

$3,255,000,000 |

| FY31 |

$2,025,000,000 |

|

$3,255,000,000 |

*IRA funding available only for practices that “directly improve soil carbon, reduce nitrogen losses, or reduce, capture, avoid, or sequester carbon dioxide, methane, or nitrous oxide emissions, associated with agricultural production” (P.L. 117-169)

*$8.45 billion in IRA funding available for NRCS to obligate through FY31

*As of February 20, 2025, $1.8 billion of the IRA EQIP funding has been obligated

Based on just the IRA EQIP funding obligations through Feb. 20, 2025, the total EQIP funding FY26 through FY31 under current law and OBBB is as follows:

- Current law - $18.8 billion ($12.150 billion baseline + $6.65 billion unobligated IRA Funding)

- OBBB - $18.53 billion

However, because more IRA EQIP funding will be obligated before the OBBB passes, the final totals will likely result in the OBBB providing slightly higher overall funding from FY26 to FY31. Lastly, because the new funding in the OBBB is structured as the baseline (as opposed to temporary IRA funding), the higher baseline funding will likely pay dividends by establishing this new high-water mark for future farm bills or other reconciliation bills.

While the EQIP program funds a range of practices, in recent years it has funded between approximately $150 and $300 million in irrigation and irrigation-related practices, making it a very significant program to the ag irrigation industry. If one accounts for the cost share paid for by producers under the program, the irrigation expenditures driven by EQIP get even larger. By way of comparison and according to the Irrigation Association’s 2020 Economic Impact Study, the estimate of total direct spending for crop irrigation equipment and installation was $2.377 billion. This comparison provides a sense of relative scale of the EQIP-related irrigation expenditures compared to overall expenditures.

The IA continues to monitor these developments closely and is actively evaluating parallel strategies to advance irrigation modernization through legislative, regulatory and administrative channels. Additionally, the IA is actively developing policy and programmatic initiatives to help producers access this funding and ensure that irrigation continues to be a central focus of EQIP’s conservation impact.

(June 25, 2025)

As temperatures rise and drought intensifies across much of the country, the U.S. Senate is advancing its sweeping reconciliation package — the “One Big Beautiful Bill” or OBBB — which includes tax policies that directly affect irrigation and landscaping businesses. This legislation, still subject to review by the Senate parliamentarian, would embed provisions that support workforce training, equipment investment, and research and development for businesses across the sector.

Here’s how these changes would play out in the day‑to‑day operations of an irrigation contractor:

- 529 Expansion for Certifications — The OBBB allows 529 savings plans to cover industry‑recognized credentials, making it possible for a technician to use tax‑advantaged savings to obtain a certified irrigation technician or designer credential. This can help contractors build a more skilled workforce and stay competitive.

- R&D Expensing — By restoring full expensing for research and development, a manufacturer can immediately write off the cost of creating a new smart controller or soil moisture sensor. An irrigation contractor that develops in‑house scheduling tools or trials new water‑saving technologies can now recapture those investments more quickly.

- Full Equipment Deductibility — Making 100% bonus depreciation and expanded Section 179 expensing permanent allows a landscaping or irrigation company to upgrade equipment — from trucks and trenchers to smart controllers and monitoring sensors — and deduct those costs right away. This frees up cash for growth and improvement every year.

- Fair Interest Deductibility — The OBBB restores a more favorable EBITDA‑based cap for the deduction of business loan interest. An irrigation contractor financing a new piece of equipment or expanding their service area can maintain more cash flow for operations and growth.

- 199A Deduction Enhancement — The Senate bill would make the 20% Qualified Business Income deduction permanent and expand the phase‑in range for service businesses and other entities subject to the wage and investment limitation. This adjustment increases the threshold for single filers from $50,000 to $75,000 and for joint filers from $100,000 to $150,000, while introducing an inflation‑adjusted minimum deduction of $400 for taxpayers with at least $1,000 of QBI from one or more active trades or businesses.

The Irrigation Association will continue to track developments closely and keep the industry informed as the Senate prepares for a final vote and the House considers its next steps.

(June 11, 2025)

Tariffs and trade relationships continue to evolve, and here are some updates as of June 11, 2025, that may be of particular interest to the irrigation industry:

- Canada – The U.S. imposed a 25% tariff on all non-USMCA compliant goods; Canada retaliated with its own tariffs on select goods, which don’t appear to have a significant effect on finished irrigation equipment.

- Mexico – The U.S. imposed a 25% tariff on all non-USMCA compliant goods; Mexico has not retaliated with its own tariffs.

- China – The U.S. and China announced the framework for a deal on June 11 that would result in tariffs on Chinese imports of 55% and tariffs on U.S. imports into China of 10%; details have yet to be released.

- Universal baseline tariff – The universal baseline tariff of 10%, first announced on April 2, 2025, is still in place for imports from all countries unless covered by specific exemptions or higher reciprocal rates like those above.

There are a number of useful tariff trackers out there that are periodically updated, including this one by the law firm Reed Smith. Given the dynamic nature and complexity of trade and tariffs, one should always consult with trade and legal professionals for the latest information and determining how it applies to a given product and situation.

Despite the continued uncertainty, there are some factors that may help limit or mitigate the irrigation industry’s exposure to tariffs. For example, in May the Irrigation Association wrote about how the irrigation industry in the U.S. exports far more center pivots and other irrigation equipment (both agricultural and landscape) than it imports. Being a net exporter of finished irrigation equipment, retaliatory tariffs are of greater importance, and to date retaliatory tariffs have been limited from key trading partners such as Canada, Mexico and Australia.

Another example of how tariff exposure could be mitigated relates to the supply chain for the plastics used in irrigation products, such as the black plastic polyethylene. Significant domestic plastic production occurs in the Gulf Coast region as well as the Ohio Valley and the Midwest from a feedstock of domestically sourced natural gas. As a result, the plastics industry enjoys a trade surplus, but China and other countries are still important to the plastics industry as a whole as reflected in this statement from the PLASTICS Industry Association - Across-the-board Tariffs Harmful to Plastics Industry, Says Seaholm.

Tariff impacts on plastics may be mitigated because the plastics industry has the potential to both use a higher percentage of its existing production capacity and expand in the U.S. in the future given the existing base of plastics manufacturing activity. For details, see this analysis by the PLASTICS Industry Association’s chief economist, Perc Pineda, PhD.

These factors may be even more favorable to the irrigation industry. Looking at data from the U.S. Census Bureau’s USA Trade Online, here are the import/export numbers for select polyethylene products, which are used to make the black plastics commonly used for many irrigation products:

| Product (HTS Code) |

U.S. Imports - 2024 |

U.S. Exports - 2024 |

| Polyethylene resin (LLDPE) – 3901.10.5000 |

$766,242,388 |

$3,997,463,860 |

| Polyethylene resin (HDPE) – 3901.20.5000 |

$1,477,493,920 |

$5,223,098,281 |

Without data on the trade shares relative to domestic shipments and given the irrigation industry is only a relatively small consumer of polyethylene, this trade data remains an imperfect snapshot. Nonetheless, the fact that polyethylene resin exports significantly exceed imports reflects that robust plastics manufacturing capacity exists in the United States. It also suggests that domestic manufacturing is cost competitive globally. Domestic supplies of important plastics, like polyethylene, should help limit tariff impacts on these inputs to many irrigation products.

The bottom line is that both the tariffs in place today and the ongoing uncertainty are headwinds for the irrigation industry, but at the same time some factors like the strength of finished irrigation equipment exports and the availability of domestic plastics industry will likely offer some help in limiting or mitigating the impacts.

(May 14, 2025)

As global trade negotiations evolve under the Trump administration, the Irrigation Association is monitoring developments that could impact irrigation equipment exports. A key area of focus is the potential effect of retaliatory tariffs from top export markets, particularly those with close trade relationships under the United States-Mexico-Canada Agreement (USMCA), which is the trade agreement that replaced the North American Free Trade Agreement. Notably, irrigation equipment exports from the U.S. to China are very limited.

To better understand the current trade environment, we examined data from the U.S. Census Bureau’s USA Trade Online, which tracks exports by Harmonized Tariff Schedule (HTS) codes. The most relevant categories for ag and landscape irrigation products include:

- 8424.82.0010 – Self-Propelled Center Pivot Irrigation Equipment

- 8424.82.0020 – Other Irrigation Equipment for Agricultural or Horticultural Use (e.g., lateral move systems)

- 8424.82.0090 – Other Agricultural or Horticultural Spraying and Dispersion Equipment

Center pivot equipment exports – 2024 highlights

In 2024, U.S. exports of center pivot irrigation systems (HTS 8424.82.0010) totaled $86 million. Notably, nearly 70% of these exports went to just two countries (Canada and Mexico) with a much smaller portion going to Australia shown below. Exports to other countries were more limited in number and value:

- Canada: $29.6 million

- Mexico: $27.8 million

- Australia: $5.5 million

In contrast to U.S. exports, the U.S. imported only $6.2 million in center pivots last year, confirming the strength of domestic manufacturing in this segment.

Broader irrigation equipment exports (both ag and landscape) – 2024 highlights

Exports under HTS codes 8424.82.0020 and 8424.82.0090 — covering a wider range of irrigation components — reached $485 million in 2024. Leading destinations included:

- Mexico: $117.6 million

- Canada: $64.4 million

- Australia: $42.9 million

There are significant U.S. exports to some countries beyond these three leading destinations and may be covered in future analyses by the Irrigation Association.

In contrast to U.S. exports, the U.S. imported $119.6 million of other irrigation equipment in 2024 covered by these HTS codes, maintaining a net export advantage.

Tariffs in the USMCA region matters

Together, Mexico and Canada accounted for nearly half of all U.S. irrigation equipment exports last year — more than $239 million across all product types. This underscores the vital importance of the USMCA trading bloc to our industry.

A good source of up-to-date tariff information can be found here at the Trump 2.0 tariff tracker | Trade Compliance Resource Hub compiled by the law firm Reed Smith. Here is a summary of where things stand with Canada and Mexico of relevance to irrigation equipment exports.

The Trump administration imposed a 25% import tariff on goods from Canada and Mexico that initially took effect on March 4, 2025. These tariffs were later suspended on goods that are eligible for duty-free trade under the USMCA. In 2024 about 38% of Canadian exports entered the U.S. duty-free under USMCA (Source - WSJ). The rules for determining duty-free status are very complex and specific to where components of a specific product are sourced and assembled. Therefore, one can’t make categorical determinations as to whether irrigation equipment is duty free.

Canada responded by placing tariffs on billions of dollars of specific U.S. imports, including fruits and vegetables, appliances and liquor, as well as its own 25% tariff on goods that are not duty-free under the USMCA.

Mexico has not imposed retaliatory tariffs on U.S. exports.

Tariff considerations moving forward

As trade dynamics continue to shift, the IA will provide members with timely updates and data-driven insights to help navigate global risks and maintain access to vital export markets. The analysis of 2024 irrigation equipment exports clearly shows that Canada and Mexico serve as major buyers of U.S.-made irrigation systems, and the USMCA and good trade relations with these partners is critical to the irrigation industry.

(May 12, 2025)

Professionals in the residential landscape irrigation industry can leverage two key forward-looking indicators to anticipate market trends: single-family building permits and the Leading Indicator of Remodeling Activity (LIRA). These metrics offer valuable insights into upcoming demand for irrigation services and products.

Single-family building permits, reported monthly by the U.S. Census Bureau, reflect the early stage of development for new homes. An uptick in these permits suggests a forthcoming increase in residential construction, which typically leads to heightened demand for landscape development, including irrigation systems. The most recent release is from April 17, 2025, and one can find useful graphs and time series for this data here. The U.S. Census Bureau data is updated monthly, with the next release scheduled for May 16, 2025.

The Leading Indicator of Remodeling Activity (LIRA), published quarterly by Harvard’s Joint Center for Housing Studies, projects short-term trends in national home improvement and repair spending. This indicator helps identify future turning points in the remodeling market, which can signal increased opportunities for irrigation upgrades and retrofits in existing homes. The LIRA is released in the third week after each quarter's closing. The most recent report published April 17, 2025, is titled Continued Gains Projected for Remodeling Amid Economic Uncertainty. While not reported separately in every quarterly report, the data includes outside property improvements such as landscaping or sprinkler systems. See the Improving America’s Housing 2025 report for details on data collection.

By monitoring these indicators, irrigation professionals can better align their business strategies with anticipated market demands, ensuring they are prepared to meet the needs of both new construction and remodeling projects.

(May 9, 2025)

As Congress deliberates in 2025 over President Trump’s proposed “big, beautiful bill”—a sweeping tax reform package aimed at making the 2017 Tax Cuts and Jobs Act (TCJA) provisions permanent—one provision garnering significant attention is the potential extension of 100% bonus depreciation under Section 168(k). This provision allows businesses to immediately deduct the full cost of qualifying equipment in the year it is placed into service. For farmers and large-scale agricultural operations considering the purchase of center pivot systems, drip irrigation, pump equipment, smart controllers, and other ag machinery and equipment, this accelerated tax benefit can dramatically lower the effective cost of investment.

The current target for passing new tax legislation, which could include extending 100% bonus depreciation, is July 4, 2025.

If an extension for 100% bonus depreciation is passed in the summer of 2025, this has the potential to increase irrigation equipment orders in Q3 and Q4.

Current phase-down of bonus depreciation

Under the TCJA, 100% bonus depreciation was available for qualified property acquired and placed in service after Sept. 27, 2017, and before Jan. 1, 2023. However, this provision is currently phasing down:

- 2023: 80%

- 2024: 60%

- 2025: 40%

- 2026: 20%

- 2027 and beyond: 0%

This gradual reduction diminishes the immediate tax benefits for equipment purchases, potentially impacting investment decisions in the agricultural sector. See the Iowa State University Center for Agriculture Law and Taxation article Expiring Tax Provisions Big Issue for 2025.

How 100% bonus depreciation benefits farmers

For example, a farmer purchasing a $100,000 irrigation system in 2025 would, under the current 40% bonus depreciation rate, be able to deduct $40,000 immediately. Assuming a 24% tax bracket, this results in a tax savings of $9,600. However, if 100% bonus depreciation were reinstated, the immediate deduction would be the full $100,000, leading to a tax savings of $24,000 — an additional $14,400 in savings. This immediate tax relief improves cash flow, allowing for reinvestment into farm operations or debt reduction.

Legislative outlook and considerations

The proposed extension of 100% bonus depreciation is part of a broader tax reform effort currently under consideration in Congress. The “big, beautiful bill” aims to solidify the tax cuts introduced in 2017, with discussions ongoing about the scope and funding of these provisions. While the House aims to pass the legislation by Memorial Day, the Senate has set a target date of July 4. The reconciliation process being used allows for passage with a simple majority, bypassing the filibuster, but internal divisions within the Republican Party and debates over spending cuts and deficit impacts present challenges.

Consultation with tax professionals advised

Given the complexity of tax laws and the potential changes on the horizon, farmers and agricultural business owners are strongly encouraged to consult with their legal and tax advisors. Professional guidance can help navigate the nuances of depreciation provisions, ensure compliance with current regulations and optimize tax strategies tailored to individual circumstances.